|

Català

| Castellano

| English

| Français

| Deutsch

| Italiano

| Galego

| Esperanto

En aquest lloc «web» trobareu propostes per fer front

a problemes econòmics que esdevenen en tots els estats del món:

manca d'informació sobre el mercat, suborns, corrupció,

misèria, carències pressupostàries, abús de

poder, etc.

|

|

|

Chapter 4. The money system today. After going through the history of the money systems, we will devote this chapter to a more detailed analysis of the present money system and of the serious social problems produced by this system, both with respect to domestic market and society, and with respect to foreign trade and world society. 2. Ways of the present money system. All along the evolution of the money systems, there has been a deeper and deeper gap between the real-intrinsic value of precious metals and the subsidiary-abstract value of the monetary instruments. With the arrival of paper money, these two realities were definitely dissociated and since then they had nothing to do with each other. At this point of development, the money system, free from the heavy burden of metals, can evolve to forms more and more intangible, more dematerialized, more abstract, in accordance with its original nature. And this is what has really happened and what still happens at present under our own eyes. Today paper money, completely disengaged from gold, is no longer the only monetary instrument in use. To it has been added the so-called scriptural money or bank money, which is an invention of the banks to face the shortage of paper money. Its emission is officially controlled by the State through its national bank. Scriptural money consists in recording money units in a current account opened in a bank. A given quantity of paper money is deposited in a bank and the bank opens a current account for the same quantity, where there will be only records of movements of money units. Payments and collections will no longer be made by delivering bank notes from hand to hand, but only through a play of recordings in different current accounts: the customer's and the supplier's. However, at any time the holder of the current account, if it is at sight, can transform the amount of his account into paper money. From this point of view, the money circulation represented by a movement of records between current accounts, must be considered a subsidiary of the circulation of paper money, as it has not a total independence. Scriptural money circulation has become the first monetary instrument in all the countries where the development of trade and industry unite to multiply the exchages made: it is very convenient, it does not get lost and, above all, as we will see in the following paragraphs, is pre-eminently the means of the bank credit. In some countries the circulation of scriptural money can represent as much as 80% of the total money circulation. On the other hand, the continuous technological evolution is rapidly transforming scriptural circulation into electronic circulation: some simple electric buttons and some magnetic memories are enough to do the recording; even the ordinary «cheque book» can be substituted by sophisticated systems of electronic transfer of funds. This growing dematerialization of the monetary reality is the most evident proof of its fundamentally instrumental-abstract nature. 3. Invention of money in present money system. At present there are two different forms of monetary instruments:

Since in principle there are two parallel monetary circulations, we will have to consider two sorts of invention of money which take place at present. A. Invention of money as paper money. This happens when new bank notes are emitted in a higher quantity than that existing at the time. This supplementary emission of bank notes (or of coins) can be made every time the national bank effects one of the following operations:

B. Invention of money as money units recorded in current accounts. We have already said that circulation of scriptural money is subsidiary to paper money circulation, but this does not make it less important. Certainly, the system of recording in current accounts avoids circulation of many bank notes; but it also allows the creation of a new monetary circulation. To obtain this, the bank simply opens a current account without previously depositing bank notes. This is today the most usual way of bank credit, whether it is a normal credit, discount of bills or pawning of securities. In principle, the only limitation to the extension of this form of credit and therefore the invention of money is the fact that any sight deposit -including those which are the result of a credit- is immediately convertible into bank notes by simply asking. For this reason, it is necessary for the emitting bank to hold a prudent relationship between the total of paper money deposited in the bank by the public and the total of granted credits, in order to always secure this convertibility. Therefore, banks cannot invent boundless buying power, and must be submitted to a given proportion between invention and paper money deposits. If we make a more exact analysis, the theory commonly accepted by specialists shows that the possibility of inventing scriptural bank money depends from three realities:

Since cash coefficient is fundamental to insure liquidity of the bank, that is its ability to transform deposits into cash, the national bank has two main instruments to insure it:

From what has been previously said, it appears that the national bank has a fundamental controlling role in the process of creating scriptural bank money: in the first place for its initiative as an inventor of paper money, and in the second place because of the instruments of monetary policy it has to supervise and control the action of private banks. But this idea of reality, which is currently accepted and defined by most of the experts, can be discussed and questioned in its main aspects. In the following paragraphs we follow the article of Francisco Vergara «Les faux-fuyants du monétarisme2». The first thing to be said is that the national bank itself cannot control its money emission. We have already said that the national bank creates money every time it produces bank notes for credit. Now the national bank cannot refuse the banks to rediscount paper signed by solvent companies, without jeopardizing the whole pyramid of credit, and it has no means to avoid the increase of nominal value of such paper; the increase of course elevates the value of the money mass. In the second place, the instrument which has always been considered the best means for limiting bank credit, that is the increase of the re-discount applied by the national bank, apparently obtains results opposite to what was expected, that is a higher rise of the money mass, because the high interest rates atract capital. Finally, it is necessary to point out that nowadays there are many other forms of liquidity, besides paper money and scriptural bank instruments, as they cannot be controlled by the national bank. The confusion of this situation can be easily observed simply by considering the difficulty existing to define what is meant by paying means. F. Vergara mentions Lord Kaldor: «There is no clear-cut separation in the interest of the total liquidity, of what is money and what is not. Whichever the definition chosen for money, it will be surrounded by a myriad of more or less liquid instruments which can act as substitutes». Therefore, besides these legal instruments, theoretically controlled by the national bank, there are new instruments that the public accepts and uses. These instruments are born not only within the banks, but also within the companies. It is easy to deduct from the previous considerations that at present there cannot be an effective control of creation of money. The immediate result of this situation is that every bank, within the more or less severe conditions imposed by the national bank, acts according to its own interests. And there is no effective legal instrument in the geopolitical society to allow to study global strategies for all the market. It is not that the market needs, sectorial excesses or shortages of liquidity are completely overlooked: proof of this is the fact that banking at present is more than ever a good business. But means to meet these needs are focused empirically, partially and not with a view to the common wellbeing, mainly in favour of higher sectors of society. National banks have not effective instruments to control the situation. And monetary theory has not convenient conceptual solutions, since it has not been able up to now to define exactly and rigorously the idea of money system. The antistrategy of market and of invention of money followed has the most evident proof in the present inflation-deflation crisis (stagflation) which is so worrying, and to which nobody can find a solution. 4. The world diffusion of utilitarian relations. To the situation of monetary disorder which we have described, must be added all the problems derived from the present world diffusion of utilitarian relations. Trade among different countries is getting wider and wider, and more far reaching, and it is necessary to point out all the advantages and all its greatly positive aspects. Work division all over the world is a fact that must be increased, as long as it is made according to an actual equilibrium of the balances of payments: this is the main strategy to be followed to insure the feasibility of foreign trade. If the domestic money system in every geopolitical society is a cause of error and confusion, it must be considered that on a world wide basis the situation is not much better. What happens is that in the comparison of currencies, stronger countries «export» their monetary problems to the weaker ones, so that the situation of the latter worsens. Monetary problems cross the frontiers and in this game there are always winners and losers. The main monetary question to be considered in every foreign trade operation , is the ways of payment to be used, as every geopolitical society has a currency with an exclusively domestic validity. This problem was easily solved in the regime of intrinsic metallic money, in gold or silver, because all the payments were made in metal accepted world wide. Under a regime of gold standard -that is of intrinsic metallic money or convertible paper money- there was still no problem, at least in theory, since convertibility of currency insured a given gold standard, and a dynamic equilibrium of balances. The equilibrium of balances is based on several mechanisms: transfer of gold from countries with a deficit to countries with a superavit; the equilibrating movement of the general level of prices, all of it reinforced by the action of the national bank on the official rate of rediscount. With the fall of the gold standard, and therefore with the interior convertibility of money units in each country, relations with foreign trade become complicated and confused. Between 1930 and 1945, several protectionist measures -such as duties, quotas, suspension of external convertibility and of the free money market, etc...- greatly reduce world trade. During World War II contracting is very high. In order to find an accepted system to restart world trade, in July 1944 is signed the Bretton Woods agreement, in which the USA in fact impose what is best for them. This agreement included:

Even if its introduction after some time allowed the relaunching and prosperity of foreign trade in the western world, the system showed some problems which soon became apparent. The first problem was the submission of the countries considered «weak» to the countries considered «strong». In fact, when a geopolitical society has a deficit in its trade balance, there are only two possibilities: to have recourse to international credit or to its currency reserve. If the deficit belongs to a geopolitical society producing reserve money, this society can actually finance its deficit by means of new monetary emissions. This was in fact the case of USA. The USA have taken advantage of their privileged monetary position up to the limit of their possibilities, by reabsorbing enormous deficits in their balance of payments through the uncontrolled emission of dollars. It must be pointed out that the origin of this deficit was not an excess of imports, it was an export of capitals not backed up by a corresponding entry of merchandise.

Since then, in spite of the attempts to find a readjustment according to the Washington agreement of December 1971, -also unilaterally denounced by Nixon in 1973- the gold exchange standard has been finally abandoned and, at present, the currency exchange is considered «floating», that is there are no fixed standards and they are negotiated in a money market. Therefore, there is no reference to a possible convertibility to gold. Currency floatation is in itself no ill for foreign trade. From this point of view, the present situation would not be especially serious if it were not for a fundamental fact: as long as the domestic currencies of every geopolitical society are not rationalized, foreign trade will not be rational either, and therefore it will not reach the necessary equilibrium of balances, which should be its main goal. It is impossible to have an equilibrated foreign trade as long as:

5. Functions of the money system today. We are now in a position to draw the final conclusions of the analysis we have developed on the money systems.

With respect to the mercantile and social functions of the money system, we can say, after what has been exposed in this chapter, that we must rather talk of irregularities: the functions traditionally taken up by money systems (see chapter 2) are completely deformed and defaced at present.

The need for a change in present day money system is the conclusion which becomes apparent from what has been said up to now. A rational and informative system must be reinvented, to accomplish efficiently the functions which, as we have seen, it had in the beginning. Therefore, in the next chapters of this essay we will describe a possible new money system, more rationally adjusted to the demands of modern market. A special importance will be given to its function of documentation and information on the market. Notes: 1When

through an incontrollable inflation, by melting coins an interesting benefit

is obtained with respect to the face value, all the coins of the sort disappear

quickly from circulation.

|

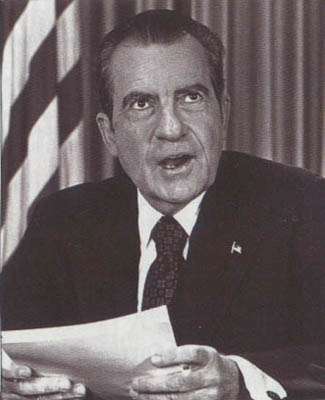

The

USA policy of financing their deficit originated such an inflation of

dollars in Europe (export of inflation), that the convertibility of

the dollar, under the point of view of official standards, established

in Bretton Woods, was jeopardized. From 1967-68 inconvertibility became

a fact, even if it was not officially declared until August 1971, when

president Nixon denounced unilaterally the Bretton Woods agreement.

The

USA policy of financing their deficit originated such an inflation of

dollars in Europe (export of inflation), that the convertibility of

the dollar, under the point of view of official standards, established

in Bretton Woods, was jeopardized. From 1967-68 inconvertibility became

a fact, even if it was not officially declared until August 1971, when

president Nixon denounced unilaterally the Bretton Woods agreement. With

respect to the nature of the money systems, their present forms show more

than ever their fundamental abstraction. The historical clash between nominalism

and metallism has been largely won by the first one, even if the

references and the defense of metallist theories still hold an interest

in many books and writings on this matter. However, most of the critics

admit now that the money system is a simple auxiliary instrument without

any need to have an intrinsic and concrete value. We need only remember

Schumpeter and Lord Kaldor.

With

respect to the nature of the money systems, their present forms show more

than ever their fundamental abstraction. The historical clash between nominalism

and metallism has been largely won by the first one, even if the

references and the defense of metallist theories still hold an interest

in many books and writings on this matter. However, most of the critics

admit now that the money system is a simple auxiliary instrument without

any need to have an intrinsic and concrete value. We need only remember

Schumpeter and Lord Kaldor.