|

Català

| Castellano

| English

| Français

| Deutsch

| Italiano

| Galego

| Esperanto

En aquest lloc «web» trobareu propostes per fer front

a problemes econòmics que esdevenen en tots els estats del món:

manca d'informació sobre el mercat, suborns, corrupció,

misèria, carències pressupostàries, abús de

poder, etc.

|

|

|

Chapter 3. Monetary reality through history. In the previous chapter, when speaking of the elements of the money systems, we have exposed our arguments in such a way as to suggest somehow a succession of steps in the evolution of the market and of the money systems therein contained. This succession of steps could be summed up as follows:

As we have already said, this interpretation is not necessarily historic; we have therefore avoided all sorts of actually historical references all along the previous chapter, and we have stressed the more theoretical aspects of the money systems. We have also said that the theoretical interpretation had been made on the basis of real historical facts. In order not to be limited just to a theoretical interpretation, which always simplifies excessively the complexity of real facts, and which besides would be considered as totally arbitrary, in this chapter we will give the actual references of the facts which have been the basis of our interpretation. These facts should establish an empirical basis for our interpretation. We must warn that reconstruction of the historical development of the monetary reality is a difficult task, both among prehistoric or ancient populations and among present day primitive peoples: existing documents are few and incomplete, and their interpretation is a delicate job. With these limitations we start. From studies of utilitarian exchange among primitive peoples existing at present, it can be deduced that in these societies barter has not a purely utilitarian character, but it fills mainly a social function. Making an ethnographic comparison, probably we could say the same of prehistoric peoples. In fact, in human groups with a simple social organization -the so-called hunting and food-gathering economies- the individual and familiar fare is produced within the community, therefore the utilitarian exchange is not vitally necessary. It is necessary from a social point of view, as it used to establish friendship and alliance with other groups or to strengthen existing social relations within the same group. Because of the great importance of this social element, primitive barter is often full of formalism, of complex rites related to magic, that is to a sacral conception of man's life. Every exchange act is considered as sacred, the same as all other social relations. 3. Monetary reality among primitive peoples. Among presently existing peoples, the knowledge and utilization of some sort of money system is to be found in three parts of the world: West and Central Africa; Melanesia and Micronesia; and the west of Northern America. It must be stressed that the peoples of all these places have advanced utilitarian relations of neolithical type, either agricultural or pastoral. This neolithic utilitarianism is, however, still little specialized: every small social producing unit can provide itself in great measure and therefore barter still holds a strongly social character. These peoples do not know any writing system, but they have money systems made up of what we have called money units and mercantile values. In fact, among the primitive peoples of the above mentioned regions -not only there, but especially in those places- some objects (which of course may vary according to the people involved) have a great social importance: they are symbols of riches and give great importance to those possessing them. Because these object are often exchanged ceremonially during some social happening, many ethonologists have compared them to a «reduced» or primitive form of metallic money which was used among all the present day civilized people, until it was definitely substituted by compulsory bank notes between 1914 and 1936. Of course, a completely different interpretation can be given. These objects seem to have two clearly separate functions. The first one, essentially social, to create and keep friendship: it is developed through a real and actual exchange of the objects in well specified occasions of great social importance. The same objects have a closely utilitarian second function, and they are standards for measuring value in the exchange of current utilitarian commodities. In this second case, these objects are never actually exchanged, they are only an abstract reference to calculate comparison among other goods valued in them. That is exactly what we have called money unit. The values applied in money units to each merchandise are the mercantile values of such goods. In some cases, the ethnographic documentation we have is not enough to confirm or discard with a sufficient empirical basis this interpretation. This depends in the first place from the prejudice of some ethnographers who lead their observation to a given reality, forgetting others more important for an overall study of primitive utilitarianism. Notwithstanding these difficulties, we have chosen a couple of examples which seem to follow the indicated direction:

We therefore say that among these peoples there are abstract money units and not real monetary objects. To extend this interpretation to all neolithic peoples who knew some sort of monetary reality, it would be necessary to make deep studies which are reserved to ethnographers. 4. Money systems of incoming civilizations. Archaeology has shown in the last decades how the first civilizations of south-west Asia (Mesopotamia, Elam, Near East), of the Indo valley, in Egypt, and later of the Aegean, of the Danube valley, etc. were born. These civilizations or «city cultures» were based on an advanced neolithic utilitarianism, with extensive cultivation of cereals and with a growing division of work. For the first time writing appears, but writing is a consequence of a previous social practice which we must mention, the current utilization of monetary instruments as the ones described in the previous chapter. From the very beginning of the neolithic age probably these societies had such money units, almost always abstracted starting from the prototypical or more important goods. In Mesopotamia, for example, they used a barley measure and later a given weight of silver. In Egypt, the common measure of mercantile values was the «uten», a copper coil of a more or less fixed weight. In Homer's Greece, the abstract money unit was the «ox». Neither the barley or silver in Mesopotamia, nor copper in Egypt, nor oxen in Greece were actually exchanged in every market operation. As we have already said, we consider these goods as money units, simply because they were taken as a common abstract measure of the value of all other goods, or, said in other words, all other goods could be evaluated in terms of these units. On the other hand also from the beginning of the Neolithic Age (8.500 b.C) there is in southern Asia a development of an accounting system with clay tokens1. Considered as a whole, this system had about 15 different sorts of tokens, with different shapes and separated in about 200 subdivisions according to sizes, marks and fractionary variations. It seems clear that every specific shape had its own significance. Some tokens perhaps show numerical values, while others represent specific objects, specially mercantile goods. We do not know exactly the use of this token system within the most primitive neolithic societies of southwest Asia, but it seems reasonable to think that it was a system to record the various operations and exchanges effected with the produce of the harvest and herds. The idea of recording, of collecting and fixing in a document2, is the embryo of a later development of the monetary instruments. In fact, these communities have slowly evolved along 5000 years with their accounting and recording system almost unchanged. When they reach the Bronze Age during the second half of the fourth millennium b.C. (from 3500 to 3000 b.C.) they suffer an important economic progress: there is a rapid increase of population in what is now Iran and Iraq; the first crafts appear and also the beginning of a high scale trade. This sort of economic explosion produces important changes in the token system, because of the pressure brought to bear by the great trade development. It is now necessary to record not only production, but also stocks, freight rates, salaries and, above all, merchants need to record their operations. The appearance of new shapes of tokens and of new sub-types is important, but still more important is the appearance of new ways of using the system. These new ways, which appeared in the last century of the fourth millennium b.C., are especially the two explained here. In the first place, about 30 % of the tokens found have a hole. This might mean that some tokens concerning a specific operation were stringed together as a book. But even more interesting is the appearance of «bullae» in Mesopotamia. The «bullae» were some sort of clay pots or envelopes to hold a number of cards. This is a direct evidence that the user wanted to separate the cards concerning a given operation. The author of these researches thinks that the bullae were created to give the agents of an operation a smooth surface where the personal seals of the people implied could be stamped -according to the Syrian custom- as a way of giving legal force to the commercial act. The fact that most of the 300 bullae discovered up to now have stamps of two different seals confirm this hypothesis. We have therefore an actual monetary document, which records all the specific peculiarities of every actual exchange, besides the seals (which are like signatures) of the persons involved. Beyond what Schmandt-Besserat says, we might introduce a further hypothesis: that these monetary documents might have worked as the monetary instruments we have described in the previous chapter. Besides being a documentary record, bullae might have been used for an accounting inter-compensation. This second hypothesis is more risky than the other one, as we have no real facts to sustain it empirically. However, some tokens make it indirectly plausible. We can make two verifications.

Even if the two considerations do not say anything directly on the existence of monetary instruments-documents, they do allow us to say that the necessary technical elements for the existence of such instruments were already available. Complex systems of accounting and compensation between accounts had already been developed. Therefore it is possible that during the second half of the millennium may have been developed in Mesopotamia a money system based on the monetary instruments-documents, at least among the great merchants and the temple. In this system the temple may have had a banking role. Of course it is necessary to find more direct proofs for the suggested hypothesis. But it is also true that many a prejudice have been opposed for a long time both to the statement of this hypothesis and above all to the research of the empirical data which might sustain it. In the first place the metallist prejudice -that is the a-critic belief that the first monetary means were the real metallic means- has led research through predetermined paths and has precluded consideration of central points for a new interpretation. Among the thousands and thousands of pages written up to now on the first civilizations, there are few references to the actual way in which monetary exchanges were effected, and even less are the interpretations of the few existing data on this subject. Finally, we must point out that the bullae became at a later date the famous tablets of cuneiform writing. As a matter of fact, the tokens which were stored within the bullae were indicated through outside marks; until they discovered that these marks were clear enough and the tokens were no longer necessary. Writing had been born. As soon as the first monetary instruments-documents appear, the elemental barter, that is the direct exchange of goods for goods, disappears for the first time, to give way to the delayed exchange which we have called elemental monetary exchange. Probably these instruments-documents were only used by the great merchants; but even so, the simple introduction of elemental monetary exchanges in the market has as a direct result that for the first time the equilibrium of the global market is taken into consideration. In fact, when all the market works on elemental barters, this market must necessarily be in equilibrium, because every elemental barter is self-balanced. But when elemental monetary exchanges are introduced, even only in a small proportion, the global equilibrium of the market disappears because the elemental monetary exchanges do not present a real equilibrium between two real merchandises, but only an artificial equilibrium, inter-accounts, between a real merchandise and some money units which have arbitrarily been appointed. To re-establish the real equilibrium of the global market, we must appeal to a strategy: the strategy of equalizing the total value of the available buying power. This strategy is called invention (or exvention if applicable) of money or buying power. Probably the ancient priests of Mesopotamia were aware of this problem and solved it, since they first introduced operations of loans and credits, that is professional banking operations. 5. Introduction of real metallic money. The monetary instruments-documents were introduced as simple instruments, as a simple accounting device to avoid problems of barter. They were therefore of a radically abstract-auxiliary nature and had no intrinsic value. Their working did not imply the exchange of any real object, only the reference to an abstract money unit. Even if the money unit was represented symbolically by a real merchandise (a sack of barley, an ox...) these goods did not actually take part in the operations. They were used as an abstract reference to the value of the exchanged goods and not to be exchanged for other goods. In Mesopotamia, probably from the middle of the third millennium b.C., appears a new type of monetary instrument: metallic coins. Together with the progress in evaluating metals (weight, quality...), the custom of paying cash becomes general: we must keep in mind that one of the money units in Mesopotamia was the siclos (with its multiples and submultiples), that is a weight for a precious metal. Little by little there was a change from paying with a monetary instrument-document to paying in cash. Even if at the beginning the practice of recording every elemental operation -through the presence of witnesses and the use of a money instrument-document- is carried on, little by little it is forgotten and cash payments are effected without any documents, completely anonymous. The circumstances which brought about this change of direction in money history cannot be easily explained. Among them the most significant might be:

In this system the monetary instruments-documents, auxiliary-abstract, free from intrinsic value, become real monetary instruments with intrinsic value, without any documentary value. A real merchandise, a precious metal (gold, copper, silver...) is chosen among all others to act as a paying means in any exchange of all the others. Therefore, in this system the money unit is called merchandise money. In Hammurabi's time (1792 to 1750 b.C.) it is a normal practice in Babilonia to use gold, silver or copper ingots. But not only in Mesopotamia this decisive change was introduced. Let us remember some of the historical civilizations which adopted sooner or later the new money system. In the Indus valley, copper bars were used; the Hittites used iron ingots; at Mycenae, bronze plates imitating animal skins; in China, bronze plates like dresses, etc. The first metallic money instrument had very different shapes and metal qualities, even within each civilization and each state city. Therefore in each operation metal had to be weighed and probed. Later, to avoid this problem, metal pieces used had a weight and quality according to norm. The guarantee was the seal of the person who stamped the pieces: these pieces are the actual coins. The first coins to be documented are from the VII century b.C. in Asia Minor. While at the beginning anybody with sufficient authority and riches could mint his own coins, at a later date this function became an exclusive monopoly of official bodies. It is easy to understand that when the use of metallic money becomes general, one of the basic characters of the primitive money instruments is lost: documentation. In every mercantile operation the only function of metallic money is to be a paying means, that is an instrument which allows a good transaction to be made. By delivering some coins, any situation of market exchange can be considered as paid and settled. 6. From metallic money to paper money. Metallic money spread quickly and was well accepted by all the civilized peoples of antiquity. However, its own nature held the seed of its obsolescence. In fact, metallist systems have a very precise limitation to their development: the quantity of minting metal in every geo-political society at any given time. This limitation is so precise, that soon it became apparent that the systems of metallic and concrete money had to be discarded to go back little by little to money systems whose character was an absolute abstraction. As we have already said several times, money systems are abstract constructions with the function of making the exchange of real goods easier, because of their evaluation. These abstract constructions are simple images of the real goods exchanges and must circulate simultaneously, evolving and being adapted to them. When this adaptation does not happen spontaneously, it becomes necessary to introduce an appropriate monetary strategy: the invention of money. In a regime of metallic money this strategy becomes impossible. In fact the philosopher's stone which transforms any metal in gold has not yet been discovered, therefore it is not possible to increase at will the existence of monetary metal when it is insufficient for the quantity of goods on the market. Every time a market becomes in excess dynamic and productive, the lack of minting metal causes new sorts of monetary instruments to appear, less limited in their possibility of expansion. Historically, bankers have been originators -and main beneficiaries, even if not the only ones- of these new forms of money, more and more abstract and far from the reality and intrinsic value of metallic money. Let us see now, very shortly, the history of this return to the necessary abstraction of the money system, which is not definitely reached until 1914. Already in the Middle Ages, in Europe, the shortage of precious metals urged kings and other minting authorities to effect money manipulations either secretly or publicly. Since the coinage and legal circulation of money were in their hands, these authorities could make the face and legal value of the coins not to correspond to the actual value of the metal. This could be done in two different ways: by minting new coins with the same face value but with a lower contents of metal; or oficially and artificially increasing the face value of the pieces in circulation. This way, the minting authority could effect payments using a smaller quantity of metal. These proceedings were ordinary practice during the whole of the Low Middle Ages, when royal treasuries were almost permanently indebted and could solve their problems with this monetary stratagem. But this solution was short lived, as the logic consequence of the manipulations was the increase of prices and salaries; an increase which produced a new difficulty to the treasury, which was compelled to effect new manipulations, starting an endless cycle. Of course the ones to suffer more were always the lower classes, who had not enough buying power to face the price increases, and who could not manipulate the money which was imposed on them. With the money manipulations of the Middle Ages the gap is opened, which will begin the separation of the actual value of the concrete metallic money from the money value which is artificially applied, according to the needs of the market. When America is discovered, with magnificent treasures to be plundered and important mines of precious metals, it seems that shortage of metals is at an end. But this period of plenty is relative, because at the end of the Middle Ages an enormous development of trade has taken place and by consequence also of the need of money. To meet these needs the bankers of the time invented a new practice to face the metal shortage: the draft. At the beginning, drafts are only a way to settle debts from a distance and to avoid therefore the danger of transporting metal. But later the draft implies also a notion of credit, that is of payment delayed in time. We must point out the fact that this new sort of monetary instrument, which we might call credit paper, was already known in Mesopotamia from the beginning of the introduction of actual metallic money. The letter of credit in all its varied forms both historic and present, has a character and definition in the fact of originating a new money circultation to be added to the circulation of metallic money. When a draft goes from hand to hand, being used as a paying means currently accepted, it is a simple promise of paying cash at a given date; but this cash does not exist yet. Therefore the draft does not substitute metallic money, it joins it. It is a new monetary instrument which, besides, has no intrinsic value, as the only element which keeps it going is the trust (however immaterial) that when the paying term becomes due, payment will actually take place. When a bank discounts a bill and pays it in cash, this payment is also a monetary creation, as the bank, by paying in advance uses money from its clients. In this way one only quantity of metallic money appears twice: in the current account of the depositor and in the hands of the one who has cashed the bill. This situation apparently abnormal only disappears when the draft is payed at maturity. The bank takes up the risk that the draft may not be paid, but this risk is not very important if the balance between total deposits actually made and total credits given is held within reasonable limits. The evident limitation of credit paper is that, for a very exact length of time, it is tied to the real metallic money. A draft has not a limitless duration, and the buying power it represents disappears at maturity after it has been honoured. This limitation disappears when the bank note is introduced. The bank note was invented in 1656 by Palmstruk, a banker of Amsterdam. It is simply an acknowledgement of debt by the bank producing it. The bank, instead of meeting its obligations towards its clients by giving them metallic money, delivers bank notes; in these documents the bank acknowledges its debt for a given quantity of metallic money. These bank notes, when the holder so wishes, can become metallic money. Bank notes are to the bearer, that is nameless: they have not a personalized beneficiary, and they can go from hand to hand without any limitation. They have no given term of maturity, therefore they can circulate indefinitely until somebody decides to change them for metallic money. Because of this mobility they represent a very important money circulation. Therefore there are two permanent and well differentiated money circulations. On the one hand, the circulation of real metallic money. On the other hand, the circulation of bank notes, which have no longer any intrinsic value but which hold a permanent promise of conversion into metal and therefore are based on the trust towards the emitting bank, in its ability to face conversion requirements. The circulation of bank notes has still a relationship with real money: the permanent possibility to be converted. Thanks to the possibility of emitting bank notes, the bases were set to avoid the shortage of precious metals, which even if new mines were discovered in the XIX century, were still insufficient. The XIX century is already fully industrialized: this produces a high increase of the needs of buying power at a rythm which precious metals cannot follow. Banks, thanks to bank notes, can issue higher amounts than the hard cash deposits. This is common practice, and, as we have already said, it causes no problems, as long as a reasonable ratio is held between metallic money and bank notes. Better still, this practice is absolutely necessary for the market, since through these mechanisms the necessary monetary instruments are produced when metallic money is insufficient. The money system based on the parallel circulation of metallic money and bank notes is currently called «gold standard». This system is a peculiarity of all the XIX century. 7. The non-convertible bank note. In the end, also the «gold standard» became unsuitable for the needs of a market as developed as that of the XX century. With the new evolution of the money system, monetary instruments become completely abstract, completely foreign to any real and intrinsic value. During the XIX century, central banks of several states monopolized the emission of bank notes, which then became legal. But every time a State had political or economic problems -production crises, wars, revolutions...) and had more expenses, this State had to produce more and more bank notes, until the inevitable trust crisis arrived. Everybody wished to convert his notes in metal, and the only solution for the state was to declare a compulsory use of the notes, which meant it was impossible to convert them into precious metals. Only when the situation became normal again could convertibility be re-established.

During World War I the enormous war expense almost completely emptied the chests of the participating states. Most of the gold from these states «emigrated» to the U.S.A. Banknotes were produced in great quantities and, of course, convertibility was suppressed. Since then, the money systems of the «civilized world» were distinguished by the inconvertibility of bank notes. After the war, some countries tried to reintroduce a partial convertibility, but the 1929 crisis definitely put an end to it.

The superiority of the inconvertible bank note, which we will simply call paper money, is the peculiarity of the new monetary stage. This paper money, which is still in use in our days, holds no relationship with gold nor with any metal nor real merchandise. It does not represent any quantity of gold, and it cannot be converted into it. Which is then the nature of paper money? which is its basis? Paper money is simply based on the social agreement which has made it the necessary instrument of the mercantile exchanges and on the trust given it, as an instrument which fulfils its function adequately. Therefore its nature is radically auxiliary-abstract. Its value is that of an instrument helping us in accountancy and exchange of real goods; it has an auxiliary and abstract value, and not an intrinsic and real value: this can only be a peculiarity of real goods.The money system has finally gone back to its fundamental primitive nature. 8. Bibliographic references for this chapter.

Notes: 1All

the details of the development of this system of accountancy come from

Denise Schmandt-Besserat. For its explanation we have used her article

«The Earliest Precursor of Writing»,

published in Scientific American. June 1977, Vol. 238, No. 6, p. 50-58.

|

We

must point out that an important forerunner of the inconvertible bank notes

is to be found in the Law system (1716-1720), and in the «assignats»

of the French Revolution.

We

must point out that an important forerunner of the inconvertible bank notes

is to be found in the Law system (1716-1720), and in the «assignats»

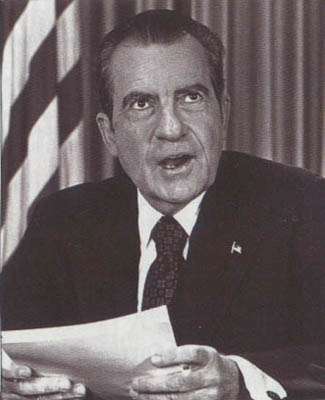

of the French Revolution. Therefore,

the system born in World War I is based on the abandonment of metallic

money, as far as utilitarian relations are concerned. In international

relations, the role of gold is held, but only until 1971, when president

Nixon untied dollar from gold, and unilaterally denounced the treaty of

Bretton Woods of 1944.

Therefore,

the system born in World War I is based on the abandonment of metallic

money, as far as utilitarian relations are concerned. In international

relations, the role of gold is held, but only until 1971, when president

Nixon untied dollar from gold, and unilaterally denounced the treaty of

Bretton Woods of 1944.